IMPROVE YOUR CAR ALLOWANCE PROGRAM

Reduce Tax Waste with an Accountable Car Allowance

Companies with accountable allowance programs should require accurate mileage logs from their mobile workers. But, the honest answer is, they don’t always. And when they do, the mileage logs they receive aren’t guaranteed to be accurate. In fact, most accountable allowance programs:

- Use inefficient, manual mileage logs

- Expose the company to unnecessary tax burden

- Do nothing to account for individual insurance

Motus offers easy solutions to these issues. That means spending less on tax waste and more on other company needs. We provide insurance verification, preventing liability within your mobile workforce by ensuring your drivers are operating lawfully. Automated mileage tracking with the Motus App is the backbone of our accountable allowance.

Interested in making the change today or want to know more? Contact us today!

Benefits of an Accountable Car Allowance

Reduce Tax-Waste

With IRS-compliant mileage logs, we guarantee reimbursements up to the IRS mileage standard rate tax free – creating savings for both employers and their employees.

Automate Tracking

The Motus App fully automates and simplifies the mileage capture process with our app so employees can focus on work.

Automate Reporting

Mileage logs are accessible any time, any place, and our best-in-class cloud platform ensures your employees never miss a mile.

The Right Allowance Program for Your Company and Employees

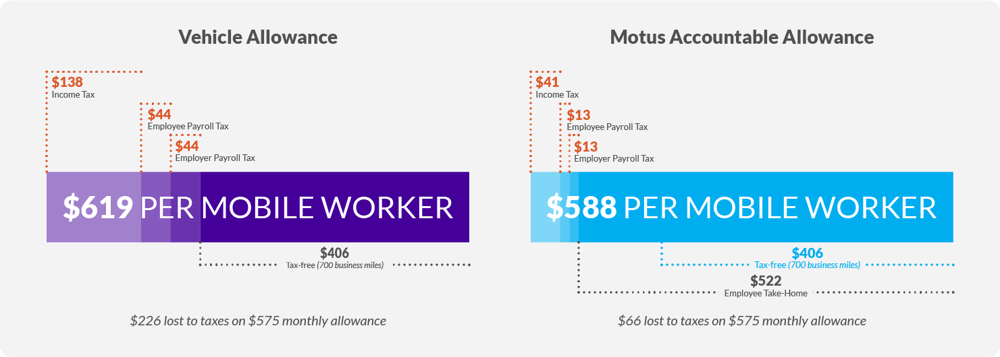

Car allowances are simple. Companies pay each of their employees the same amount every month for the business use of their personal vehicle. However, without accurate mileage tracking, a car allowance is considered additional income. Because these payments are generally above the IRS mileage rate, they're taxable and place a financial burden on both the company and the employee.

For small companies just starting out or corporations that have been around for decades, an accountable allowance will reduce tax waste and put more money in your employees’ pockets. So, let's take a deep dive into both why a car allowance is taxable and what the right allowance program can do for your company and employees!

Tax Waste Reduction Using An Accountable Allowance

With accurate mileage logs, drivers lose less of their monthly allowance to taxes. What’s more, better insights into field activity could mean regions better suited to the employee’s location and less time on the road. Employers can additionally use the tax-waste money saved to reward drivers.

NOTE: This depends entirely on the actual business mileage

About Motus

Motus is the industry leader in vehicle reimbursement and risk mitigation solutions for employees who drive. Combining 80 years of expertise with innovative technology, Motus enables organizations to optimize spend and increase productivity across their workforce. With solutions purpose-built to enable data-driven insights and strategic decision making, Motus is the preferred vehicle reimbursement partner to top Fortune 500 companies globally. For more information, please visit www.motus.com or connect with us on LinkedIn.

Trusted by Every Industry